A rising tide raises all ships. The reverse is also true. When the tide goes out, the ships are grounded. You can profit from the changes of the tide by either going long or going short with your stock purchases. At twopercentgoal.com, we are not trying to reinvent the wheel. Take what the market will give you. If it’s rising, go long. If it’s falling, go short. This is not rocket science. But how can you say with confidence which way the market is going and if you should be going long or selling short?

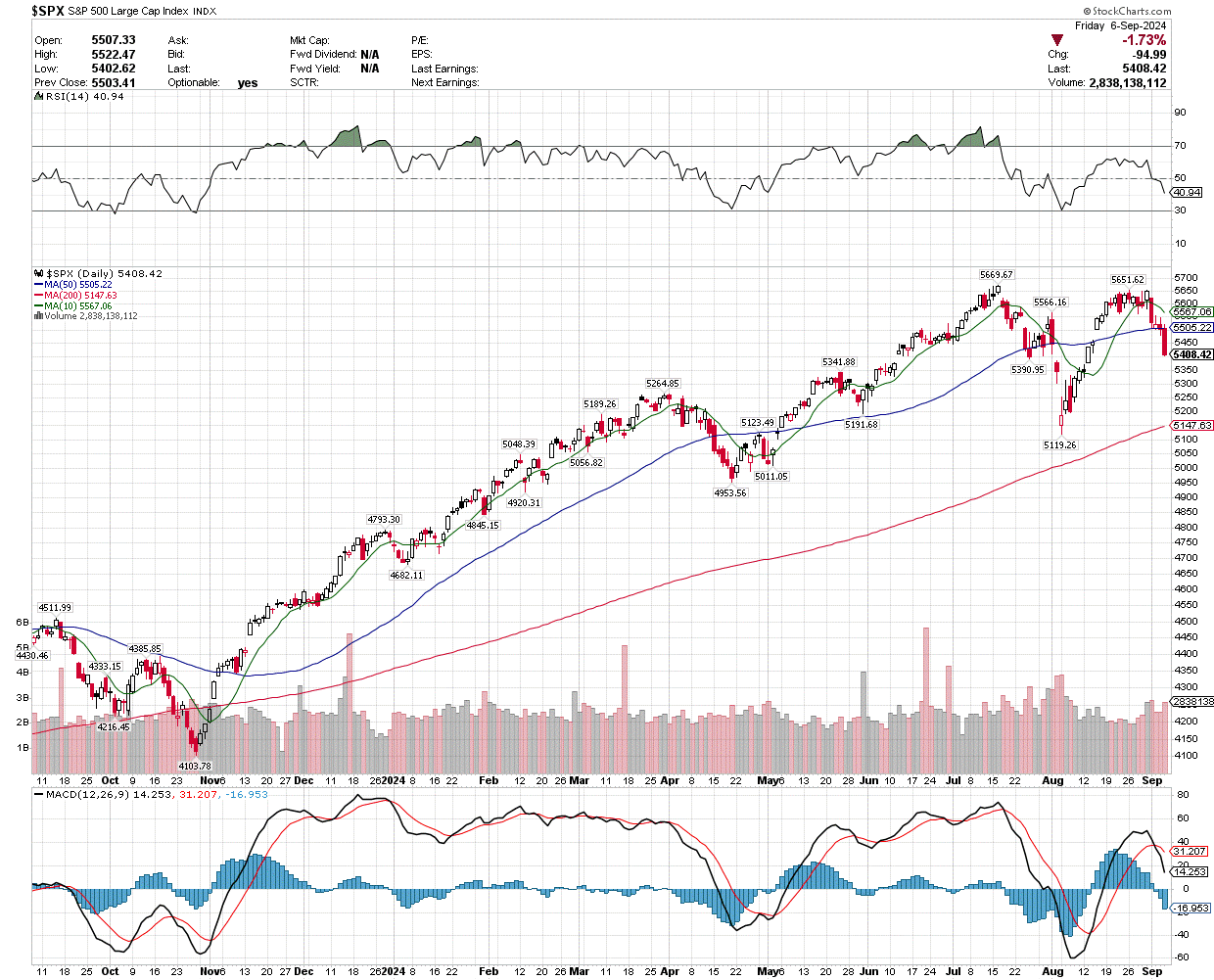

Keep it simple. I only buy from the top 500 large cap stocks on the NYSE, so look at the S&P large Cap Index. More specifically, look at its corresponding MACD chart. (I’ve talked about the MACD in previous blogs. I strongly suggest you research the MACD. It’s amazing) Now look at the slope of the MACD. When it slopes up, the index is rising, so go long. When it slopes down, the index is losing steam or falling, so go short.

Look at the above chart of the S&P Large Cap Index. You can see every time the slope of the black line of the MACD changed direction, the index changed as well. There is a direct 1:1 correlation. This is beyond coincidence. When the MACD slopes upwards, go long. When it slopes downwards, sell short.

This past week the slope of the MACD changed direction and is sloping downwards. When it changed direction, my recommendations were to sell all long positions and search for shorting opportunities. Five of seven of my short sell recommendations have reached its two percent goal and one reached its goal on the first day. The other two are in positive territory. Always trade with the wind at your back and take what the market will give you. Go to twopercentgoal.com and sign up for my daily emails of stock recommendations. The first 30 days are absolutely free.

Cheers,

Al

Recent Posts

Why I Use a Three Percent Stop Loss

Use a 3% stop loss to minimize losses

The Importance of Limit Orders

Your entry point is crucial to maximizing profit and minimizing loss

Why I Am Short Term Bearish on the Dow

Many companies are in overbought territory

A Mother’s Day Wish

Being my first teacher had a profound effect on my life. Thank you mom. Happy Mother’s Day

DISCLAIMER

Opinions and data provided are subject to change without prior notice. These opinions might not be suitable for every investor. It’s important to conduct your own research and consult with a registered broker or investment advisor. Information on various stocks, options, futures, bonds, derivatives, commodities, currencies, and other financial instruments (collectively, “Securities”) is shared here to potentially interest the audience. This content is meant for informational purposes only and does not constitute investment advice or recommendations. The buying or selling of any securities is not solicited. Additionally, none of these activities should be interpreted as providing financial advice. The information presented should not be taken as a suggestion to buy, hold, or sell any specific securities. Investing in securities comes with risks and market volatility. Past performance is not indicative of future results. It is strongly encouraged to conduct your own due diligence.