TWO PERCENT GOAL TO FINANCIAL INDEPENDENCE

Al O’Grady

Hi, my name is Al O’Grady, and I am the founder of Two Percent Goal to Financial Independence. With a degree in Economics and over fifteen years of experience in financial services, including completing the Canadian Securities Course, I’ve learned what works and what doesn’t in the financial world. This experience has made me a wiser investor, helping me achieve my goals in life.

My Ultimate Goal

My goal is to double my money on the stock market each year with little to no risk. That may sound crazy, but I feel I have the strategy to do it in bull and bear markets.

I am not a day trader. This is not a day trading strategy. I am a swing trader. What’s the difference? A day trader buys and sells his or her position within the same day. He does not own a stock before the market opens and he has closed out his position before the market closes.

A swing trader has a longer time horizon. He holds his position between a couple of days to a couple of weeks. I hold 95% of my recommendations from 3 days to 2 weeks and most of my picks are held for one week.

This is not flashy, it’s not sexy, it’s boring and it’s very effective. In order to double your money, you need to generate a 100% return. That’s an approximate average of 2% per week. That’s my goal. Find stocks that are poised to gain 2% in one week. Get in, get out, move on and repeat.

That’s the goal, what’s the plan?

Yes, I want to receive daily emails with your stock picks poised for a 2% gain. It’s free for 30 days and then $99/month.

My Plan

My 10 Essential Rules for Success

Here is what I do. The most important thing is to follow EVERY rule. By doing this you take emotion out of it, and you don’t get caught up in the hype when the stock is climbing or play the hope game when the stock declines. Here are my ten rules:

Rule #1

Invest only in the 500 largest cap stocks on the New York Stock Exchange aka the S&P 500.

You should only be looking at companies within the S&P 500. These are companies you know. They are well established companies making real products and real profits. These are companies like Home Depot, Pfizer, Exxon, Johnson & Johnson etc. What is also very important about trading these companies is that they are all widely traded and it is very easy to enter and exit a position.

Rule #2

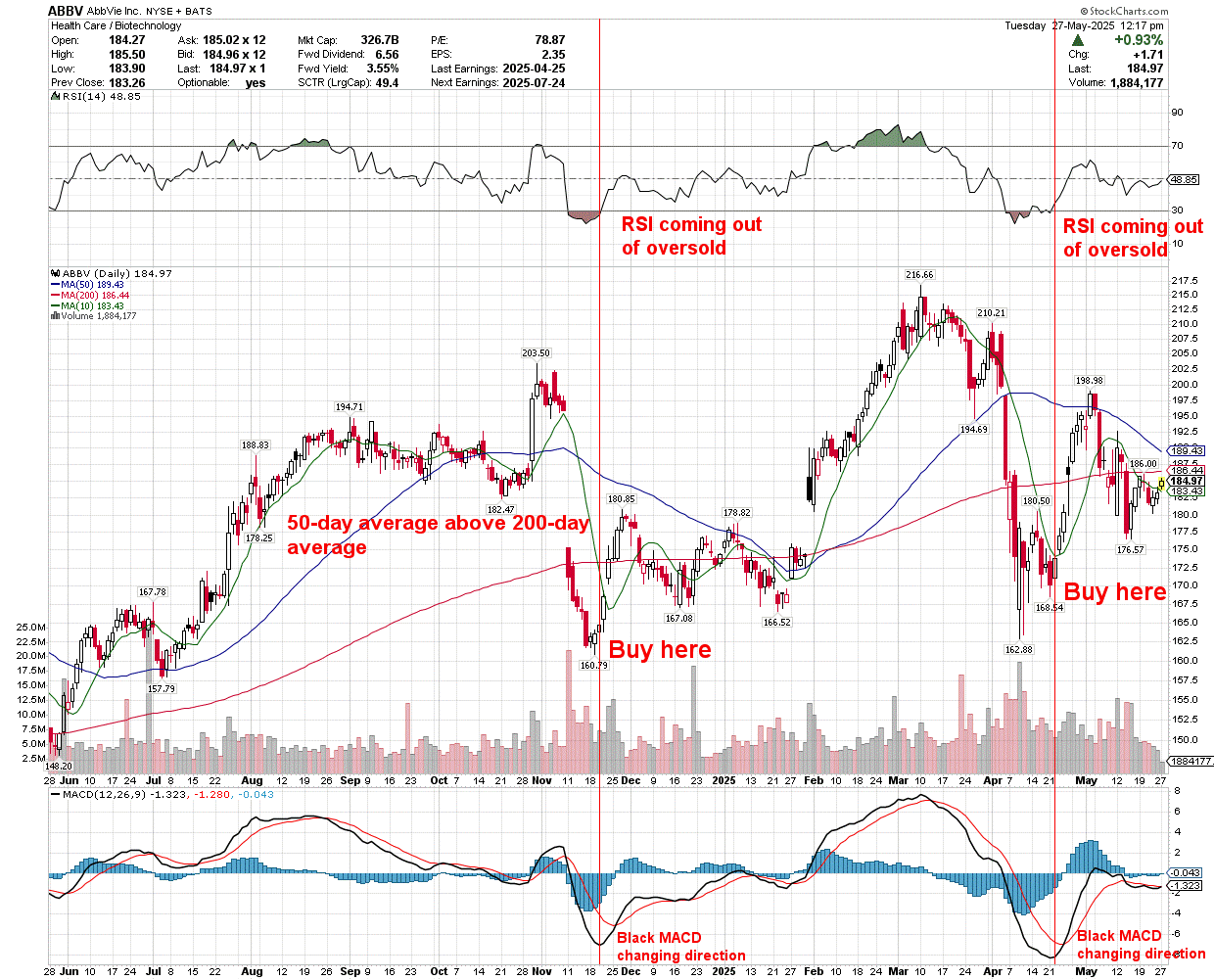

Look at 50 Day/200 Day Moving Averages

After looking at the market from a macro perspective, look at individual companies. When going long on a stock, the 50-day moving average MUST be above the 200-day moving average. NO EXCEPTIONS You want the stock to be in a climbing mode and you want to ride that trend.

-

In the above chart for IBM the blue line represents the 50-day moving average and the red line is the 200-day moving average. When buying a stock, the 50-day average must be above the 200-day average on the day of purchase.

Rule #3

Look for an oversold Relative Strength Index (RSI) combined with a confirming 50-day/200-day moving average

If the 50 day average is above the 200 day average, the stock is in a long term bullish mode. Look for the RSI to be coming out of oversold territory (ie shaded area below 30 and rising above 30). You now have a short term signal and a long term signal saying the same thing. The short term price is depressed but long term it is still bullish. Buy low in a bullish trend.

Rule #4

Look for a confirming MACD signal

The MACD (Moving Average Convergence Divergence) represents an exponential moving average. The chart is composed of two lines. A black line which represents a shorter and faster moving average while the red line is a slower, longer moving average. You want to see the black line at least flattening, but ideally changing direction. This indicates the chart is about to change direction too.

Rule #5

Use Stop Losses to Minimize Losses and Maximize Gains

-

-

Our ultimate goal is to double our money each year. We break that down into smaller bites by aiming for a 2% return per week by swing trading. No method is 100% guaranteed. There will be times when we are wrong. In order to protect yourself, after buying the stock, immediately put in a stop loss that is 3% below the settlement price. If you buy a stock at $100, your stop loss should be set at $97. This will minimize losses for those times the stock did not do what we thought it would.

-

-

Use stop losses to maximize gains as well. By using stop losses you can also ride the wave and make more than your 2% goal. Again, let’s say you entered a trade at $100. Your goal is $102. Let’s say in three days the stock surpassed your 2% goal and closed at $102.75. You set your stop loss at $102 to guarantee a 2% return. Now let’s say the intra-day low price the next day only went down to $102.50. Your stop loss order was not filled. GREAT.

-

-

Revise your stop loss to $102.49. Let’s say the stock is climbing and the next day the intra-day low was $102.75. EVEN BETTER. You revise your stop loss to $102.74. Each day you keep revising your stop loss order so that the trigger price is one penny lower than the previous intra-day low.

-

-

You repeat this process daily. Sooner or later there will be a down day and your stop loss order will be filled. You will have taken advantage of a major upswing while still guaranteeing your minimum goal.

-

Rule #6

Use Limit Orders when buying a stock

In order to maximize profit and minimze loss, your entry point is crucial. When you choose to buy a stock make sure it is a limit order and not just a market order. A market order fills your order at the going makret price while a limit order is a market order up to your limit. For example if want to buy a stock at $100 a share and you place your order before the market opens and the market opens with the stock listed at $110 a share, your order would be filled at $110 per share. I suggest using a limit order that is 1% above the closing price. So if the market closes at $100 and you place your limit order at $101, if the makret opens at $110 a share your order would not be filled. If you cannot get your order filled at the price you want, move on. There is always another buying opportunity.

Rule #7

Go Short Too.

-

-

This process works for shorting stocks as well. Everything is reversed. The 50-day average is below the 200-day average. The RSI has to be in overbought territory. (The shaded portion above 70) and has to have fallen below 70. The black MACD line needs to flatten or change direction. Short the stock that day. Don’t forget to use a limit order that is 1% below the previous day’s closing price. Look for a 2% drop as that is your goal. Use a stop gain order to lock in profits or minimize losses.

-

Rule #8

Diversify

As the saying goes, do not put all of your eggs in one basket. I strongly recommend you do not put more than 10% of your portfolio on one stock. You can diversify even more by not putting more than 5% of your portfolio on one position but you could be watching 20 stocks at one time and that could be overwhelming for some. By diversifying, any losing positions will have a minimal impact on your entire portfolio.

Rule #9

Consider Leverage

Buying your stocks on margin will drastically increase your returns while diversity minimizes risk. If you have a $100,000 portfolio, a 10% diversity factor means you would never put more than $10,000 in one stock purchase. By using a 3% stop loss, you are risking a $300 loss. If you bought this on 3x margin, you would be risking a $900 loss. A $900 loss on a $100,000 portfolio is less than a 1% loss of the entire portfolio and certainly within guidelines for swing trading.

If buying on margin is still outside of your risk tolerances, don’t do it. Try these strategies without buying on margin until you gain confidence in the program and then ease into margin slowly.

Rule #10

Repeat

A 2% gain doesn’t sound like much but if you can do it every week, you will generate a great annual return with very little risk. This method is not flashy; it’s not sexy; it’s boring, and it works.

So How Accurate is This?

From May 15, 2024 to May 15, 2025

| TOTAL SUMMARY | ||||||||

| Total Number of Recommendations | 504 | |||||||

| @2% minimum | ||||||||

| Going Long Winners (Gained 2% or more) | 299 | 598% | ||||||

| Going Short Winners (Gained 2% or more) | 82 | 164% | ||||||

| 381 | subtotal | 762% | ||||||

| Total Loss | ||||||||

| Going Long Losers (Gained less than 2%, lost 3% or less) | 75 | 225% | ||||||

| Going Short Losers (Gained less than 2%, lost 3% or less) | 37 | 117% | ||||||

| 112 | 342% | 342% | ||||||

| Net Gain | 420% | |||||||

| Total Picks | 504 | |||||||

| Net Total Average/Pick | 0.83 | |||||||

| Ratio 2% Winners to 3% Losers | 3.4:1 | |||||||

If you are a swing trader you can use my strategies to earn excellent annual returns. You can do this.

OR

I can do the research for you. I can tell you what to buy, when to buy it, when to sell it, and what your stop losses should be. Simply sign up to receive my daily emails with stock recommendations. The first 30 days are absolutely free and then it’s $99/month. If my picks do not generate a profit for the month, I will refund your $99. You can cancel at any time. This program pays for itself. Take control of your finances. Take control of your life

While the test data is overwhelmingly positive, there are risks with this type of investing and the author accepts no responsibility for any possible losses.

Don’t Believe a Word I Say

If you’re skeptical and think I’m full of hot air, I get it. That’s why I will give you the first 30 days FREE. If you sign up. I will send you notifications when to buy a stock that’s poised for a 2% jump. I’ll give you stop loss orders to protect yourself and when to exit a profitable trade. I will also send you my data where I have back tested the 500- large cap companies on the NYSE. You can examine this free of charge. There is no risk to you at all. You have everything to gain and nothing to lose. After your free 30-day trial, you can exit the program at any time. Take control of your future, take control of your life. Get started on the 2% goal to financial independence right now.

While the test data is overwhelmingly positive, there are risks with this type of investing and the author accepts no responsibility for any possible losses.